A fragile balance between global economic recovery, sovereign debt problems, and potentially threatening commodity inflation is the thematic market headline challenging investors early in 2010. However, the stock market is also reminding investors that security issues are a major business opportunity in our time. Threats to our economic security remain the primary driver of capital scurrying between asset classes, but a big challenge for economic well-being in our age is securing commerce - and the population - from threats big and small. Almost a decade after the history-altering terrorist act now referred to as 9/11 stewards of the global economy remain anxious to find systems and technological solutions to security risk. Judging by the performance of many of the stocks that represent this effort to make the world a safer place, the market is doing its job of accepting this challenge.

Although companies in the security industry range across a broad scope of service and systems – from typical security services to high tech applications of screening and warning devices – this loose grouping of enterprises devoted to reducing risks of harmful acts, as well as natural disasters, is worth watching. Recent stock market trends show that investors know the stakes are big, and that economic dislocation and crisis is a tremendous cost for failure to defend against security risk. Some of these security industry stocks are currently delivering trend trading opportunities.

One of the best performing stocks on the Toronto Stock Exchange since the market bottom almost a year ago has been Garda World Security Corp. (GW-T). This Montreal-based security services firm has a worldwide presence, but the 2008 recession pummelled its shares to a penny stock from much loftier heights. The stock took off last year, though, and became Stock Trends Bullish in early June after its initial rally more than tripled the share price from its 2009 open. Since its rebirth as a bullish stock GW has doubled in value again and is now scaling new 52-week highs as its shares approach $12. The share price would have to double again to challenge the highs prior to the stock’s 2007 perch, but trend investors can look toward an advance to the $15 area as an immediate objective.

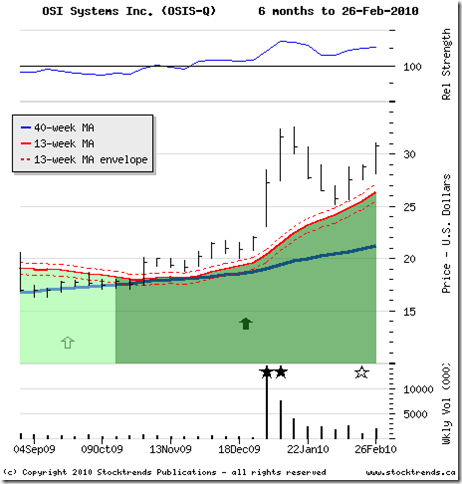

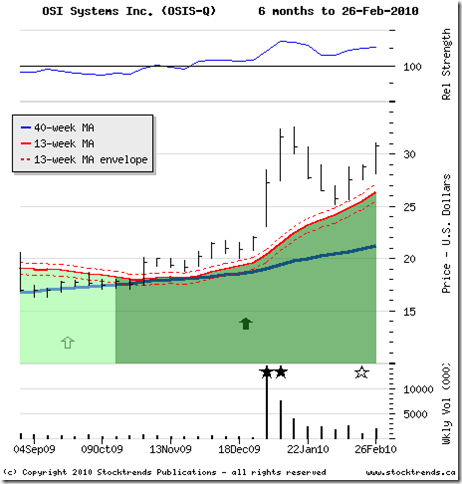

OSI Systems, Inc. (OSIS-Q), a security scanning systems provider, saw its stock break out in early 2010. Although it has been Stock Trends Bullish for the past three quarters, OSIS upward sloping 13-week moving average is now helping the stock regain a footing above $30 (US). If the share price manages to push ahead of its January high, eclipsing $33, investors will look positively toward adding to their positions.

ICx Technologies (ICXT-Q) develops sensors and surveillance systems. Its stock, along with the shares of identity security firm IntelliCheck Mobilisa, Inc. (IDN-A), had a huge breakout in the short trading week before the New Year - the holiday attempted airline bombing a blunt reminder of the powerful lever terrorist acts have on these stocks. Share prices in both companies have since slipped back to their 13-week moving average trend line and are trading only lightly now. However, investors can again look at this as another launching pad.

Another bullish trending stock, American Science & Engineering Inc. (ASEI-Q), is currently trading at its 13-week moving average trend line and could also rally to its January high. The shares of this x-ray inspection systems firm would add in excess of 10 per cent on that move.

Analogic Corp. (ALOG-Q) makes explosive detection equipment, but its stock has been somewhat of a dud since its bullish breakout in the first quarter of 2009. For the past 11 months the stock has been in a trading range, struggling to top $40 and slipping back to the $34 area. Currently the shares trade at the ceiling of the range - $42 – and could provide a cue for buyers to pick up the stock if it breaks out of the long term trading range.

Other stocks that deserve attention include L1-Identity Solutions, Inc. (ID-N), maker of biometric identity devices, L-3 Communications Holdings (LLL-N), an intelligence and surveillance systems provider, and Cogent, Inc. (COGT-Q) a name behind fingerprint identification systems. Shares of L-3 Communications rallied off trend line support a month ago and are now making new 52-week highs. L1-Identity’s stock is a current Stock Trends Bullish Crossover (signalling that the 13-week moving average trend line has crossed above the 40-week moving average trend line. Cogent will also be a Stock Trends Bullish Crossover soon.

Security stocks not currently sharing in the positive price trends of their peers include Magal Security Systems Ltd. (MAGS-Q) (computerized security systems), FLIR Systems Inc. (FLIR-Q) (thermal imaging and broadcast camera systems), and Optelecom-NKF, Inc. (OPTC-Q) (advanced video surveillance). There may be other security-related stocks not mentioned here, but surely investors should look favourably on the opportunities in this important growth industry.