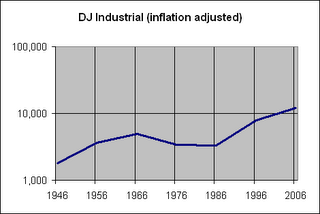

The Dow Jones Industrial Index closed above 12,000 today for the first time. This achievement has been heralded by the financial media in the usual euphoric manner, delivering both excited investors eager to join in on the rally and fretting pessimists ready to bail before it implodes. But the 12,000 marker should be put into a proper monetary context, since the DJ Industrial is a price index. Adjusting the index for inflation reveals that today's close is 15% short of the inflation adjusted 2000 high.

Revealing for investors that do not consider the effects of inflation on the value of their equity assets is the comparison of compound rates of return for the Dow in nominal and real terms. In the post-WWII era the annual compound return on the DJI index is 7.3% (excluding dividends). The real compound rate of return is only 3.2%. Of course, real returns on the index should include dividends, but the effect of inflation on the value of the asset is not diminished. For the 19-year period since the days before Black Monday in 1987 the compound rate of return (nominal) of the index, inclusive of dividends, is an impressive 12%. But applying the CPI price deflator yields a 8.6% inflation adjusted return over this incredible bull market.

The advance of the stock market will always be a battle against alternative assets. And it will always be handicapped by monetary debasement. Investors should remember this important context when making judgments about the nominal price level of equity markets. Dow 12,000? Big deal.

The graph above shows the real (inflation adjusted) level of the DJ Industrial Index at 10-year October intervals over the past 60 years. This logarithmic representation misses the volatility of the index, most appreciably the highs of early 2000, but the trend of the real price level puts the advance of the U.S. stock market in a better context.