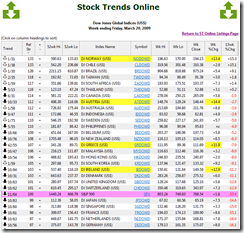

Investors can expect renewed pressure on U.S. dollar assets as the U.S. administration monetizes its growing debt. A primary driver of emerging and commodity markets is the growth trajectory of the global economy. Has globalization been derailed by the financial crisis? Will it recover soon? The uncertainty surrounding the ability of the global economy to unhinge from the troubled fiscal and monetary predicament burdening the United States recovery is acute. Although deflation remains a primary immediate concern, the seeds for re-inflation are planted. Expect capital flows to reflect the dismal prospect for the U.S. dollar. Investors should keep an eye on performing international markets. Currently, commodity markets like Norway, Chile, Brazil, Canada and Australia are ascending. The Stock Trends ranking of Relative Strength for international markets helps sort the winners and losers.

No comments:

Post a Comment